Top HR and Payroll Software for Startups in the CBD Industry

- Cannabis Cactus

- Aug 13, 2025

- 12 min read

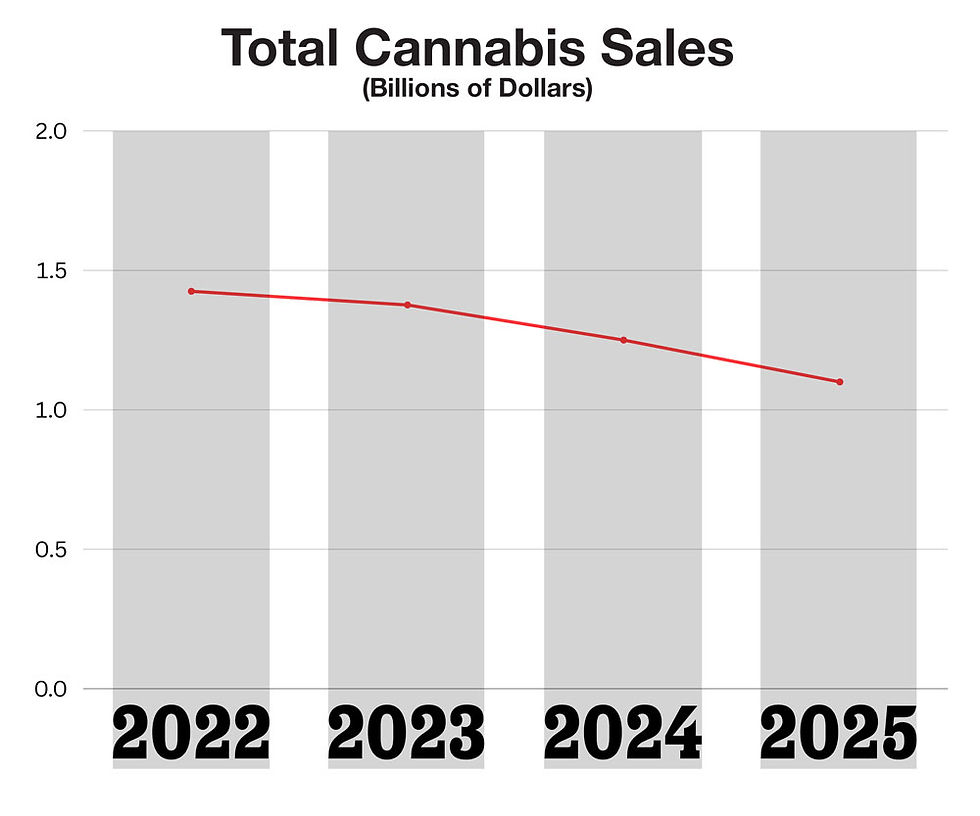

The cannabis industry is booming to a projected $57 billion by 2030, but let's be real, running payroll in this space is a unique headache. Between Section 280E tax nightmares, banks that treat you like you're invisible, and regulations that change with the wind, you're not dealing with ordinary business challenges.

If you're juggling these cannabis-specific payroll hurdles, you've probably already discovered that standard solutions fall embarrassingly short. We get it, one compliance slip-up could cost you big time.

That's why we created this guide. We've done the legwork to find payroll solutions that actually understand your industry's unique needs, with Hybrid Payroll standing out as our top pick. Let's make your payroll headaches a thing of the past.

Our Software Evaluation and Testing Process

We rolled up our sleeves and got our hands dirty with this research—no superficial software demos here. We built our evaluation process around the real headaches you face running a cannabis business.

We brought together people who live and breathe your challenges every day: CPAs who've mastered the 280E maze, HR folks who've run cannabis payroll across multiple states, and founders who've been exactly where you are now. These are people who understand what it means when the bank gives you the cold shoulder and you're counting cash in the back office.

When testing each solution, we threw real-world cannabis curveballs at them. We ran payroll scenarios across states with wildly different regulations. We tracked expenses with 280E hanging over our heads. We even simulated what happens when banking restrictions force you to pivot on payday.

And let's talk about customer support—because when you're facing a compliance issue at 4:30 on a Friday, you need someone who doesn't respond with "cannabis what?" We asked the tough questions and noted who actually understood our industry versus who was just nodding along.

We also dug into each platform's cannabis street cred. Are they newcomers just trying to cash in, or have they been in the trenches with businesses like yours? We called references, devoured case studies, and had heart-to-hearts with actual users to get the unfiltered truth about implementation nightmares and whether support disappears after they cash your check.

Cannabis Payroll Software Comparison Overview

Software | 280E Compliance | Starting Price | Key Cannabis Features | Implementation | Best For |

Hybrid Payroll | ⭐⭐⭐⭐⭐ | $45/employee | Full 280E tracking, cash payroll, multi-state compliance | Easy (2-3 weeks) | All cannabis startups |

Evolve HCM | ⭐⭐⭐⭐ | $65/employee | Enterprise compliance, multi-location management | Complex (6-8 weeks) | Large operations (100+ employees) |

EPAY Systems | ⭐⭐⭐⭐ | $55/employee | Agriculture focus, cultivation tracking | Moderate (4-5 weeks) | Cultivators and growers |

Greenleaf HR | ⭐⭐⭐⭐ | $50/employee | Full HR suite, employee management | Moderate (3-4 weeks) | Growing companies needing HR |

Kayapush | ⭐⭐⭐ | $35/employee | Dispensary-focused, POS integration | Easy (2 weeks) | Small dispensaries |

PayNW | ⭐⭐⭐ | $40/employee | Regional expertise, competitive pricing | Easy (2-3 weeks) | Pacific Northwest businesses |

Hybrid Payroll: Top Overall Choice

Let's cut to the chase, Hybrid Payroll knocked it out of the park in our testing of cannabis payroll software providers. While other companies are slapping "cannabis-friendly" labels on their regular payroll systems, these folks have been in the trenches with cannabis businesses since 2014. And trust me, it shows.

What really made us fall in love with Hybrid? They actually get what keeps you up at night. This isn't some generic system where you're constantly explaining your business model to confused support reps. They've built their entire platform around the regulatory obstacle course you navigate daily. Their 280E compliance tools aren't some hastily added feature—they're baked into the DNA of the system, designed by people who understand the difference between touching the plant and not touching it.

Core Features and Cannabis-Specific Capabilities

From day one, Hybrid Payroll built their system for people like you, not some generic business they had to retrofit for cannabis. Their 280E expense categorization isn't just a feature, it's a lifesaver that automatically sorts your payroll expenses into the right tax buckets. We're talking about hours saved every pay period and potentially thousands of dollars you won't have to shell out to your accountant for manual fixes.

Where they really blew us away was their multi-state compliance magic. If you've expanded (or dream of expanding) across state lines, you know the regulatory nightmare that creates. Hybrid handles this beautifully, automatically applying the right labor laws, tax rates, and cannabis regulations for each location. No more late-night panic attacks wondering if you missed some obscure compliance change in your newest market.

And let's talk about cash, because we all know banks still treat cannabis businesses like they have the plague. Hybrid actually built their system for businesses that deal with physical currency, with detailed audit trails and documentation that keep regulators happy and your stress levels manageable. They've clearly had conversations with actual cannabis operators who've explained what it's like counting out employee pay in the back office.

Compliance and Regulatory Support

Hybrid Payroll's real magic is in the details that matter most to your cannabis operation. Their 280E tax system doesn't just separate expenses, it actually understands which costs you can deduct and which fall under those frustrating 280E restrictions. This isn't theoretical; it's the difference between a clean audit and a costly tax nightmare.

Their state compliance features are a game-changer if you're tired of scanning regulatory websites. Their team monitors cannabis law changes across all legal states, automatically updating your system when regulations shift. You'll wake up to a compliant payroll system without the constant research headaches.

When regulators come knocking, and in this industry, they will, Hybrid's detailed audit trails have your back. Every transaction, expense categorization, and tax calculation is meticulously documented and easily accessible. No more frantic searching for documentation or wondering if you've missed something critical during an inspection.

User Experience and Interface Design

Hybrid's dashboard cuts through the complexity, exactly what you need when juggling complex compliance requirements. You'll spend your time actually running your cannabis business instead of fighting with complicated software interfaces.

Their mobile app is a lifesaver when you're bouncing between grows, processing facilities, and dispensaries. Approve payroll, check compliance status, and pull up critical reports right from your phone while you're walking the floor or checking plants.

What really impressed us was how smoothly Hybrid connects with the systems you're already using. It plays nice with cannabis-specific POS systems, inventory management tools, and accounting platforms without forcing you to overhaul your entire operation. Your team won't miss a beat during implementation.

Customer Support and Implementation

When you call Hybrid's support team with a cannabis-specific question, you won't hear "let me research that," you'll talk to someone who actually gets your business. These folks have handled 280E issues and multi-state headaches before and speak your language.

They'll get you up and running in just 2-3 weeks, with specialists who understand that in cannabis, time really is money. No dragged-out implementation when you've got a business to run.

Best of all, they'll tap you on the shoulder when regulations change, with clear guidance on what you actually need to do about it. It's like having a compliance buddy watching your back while you focus on growth.

3 Other Premium Cannabis Payroll Solutions

Evolve HCM: Enterprise-Grade Solution

If you're running a cannabis empire across multiple states with a small army of employees, Evolve HCM is your heavy-duty option. They've built the tank of payroll systems, not the prettiest or fastest, but man, can it handle the weight of complex operations.

Their compliance system doesn't mess around, it generates the kind of detailed reports that make regulators nod with approval instead of reaching for their citation pads. Got a complicated org chart with different entities and employee types? Evolve won't break a sweat.

Fair warning though: getting this beast up and running takes 6-8 weeks, and the learning curve feels like scaling Everest sometimes. At $65 per employee monthly, it's also going to take a bigger bite out of your budget than other options. But hey, if you're running the big leagues, sometimes you need big league equipment.

Their support team knows their software inside and out, but don't expect them to geek out about cannabis regulations like you do. You might find yourself explaining the difference between plant-touching and non-plant-touching employees to someone who's technically competent but cannabis-naive.

Best for: Medium to large cannabis operations (100+ employees) that require sophisticated multi-entity management and have the resources for a complex implementation.

EPAY Systems: Agriculture-Focused Platform

EPAY Systems tackles cannabis payroll with a farmer's mindset, they see your business as agriculture first, cannabis second. This approach is a breath of fresh air if you're knee-deep in cultivation operations or running the whole seed-to-sale show.

Their system shines when you're dealing with the realities of agriculture: seasonal harvest crews that balloon your headcount, piece-rate pay for trimmers, and those specialized ag management systems other payroll companies look at like they're written in hieroglyphics.

On the 280E front, they handle the fundamentals without breaking a sweat, but for those really hairy compliance situations, you might occasionally need to call in backup. They're solid, just not quite as cannabis-obsessed as Hybrid.

Price-wise, they land in the middle at $55 per employee monthly, with a 4-5 week setup that won't leave you hanging too long during transition.

Their support team knows their agricultural onions, though cannabis knowledge can be hit or miss depending who answers your call. Some reps will talk terpenes with you all day; others might need a crash course in why cannabis payroll isn't just like processing paychecks for corn farmers.

Best for: Cannabis cultivators and agricultural operations that need specialized features for seasonal workers and agricultural compliance.

Greenleaf HR: Full-Service HR Solution

Greenleaf HR is the Swiss Army knife of cannabis workforce management, they've built a system that handles everything from cutting checks to building your entire HR department. If you're growing fast and your HR "system" is currently a mess of spreadsheets and sticky notes, these folks might be your salvation.

Their platform doesn't just pay your people, it helps you find them, onboard them, and track their performance all in one place. When you're scaling from 15 to 50 employees and suddenly need actual HR processes instead of just vibes, Greenleaf has templates and workflows ready to go.

Their payroll system handles the cannabis essentials, 280E compliance, multi-state operations, the works. They've got the bases covered, even if they don't geek out on cannabis regulations quite like the specialists do.

At $50 per employee monthly, you're getting solid value considering this includes the full HR package. The 3-4 week setup is reasonable, and their support team knows enough about both HR and cannabis to keep you from making rookie compliance mistakes.

Just know they're HR people who learned cannabis, not cannabis people who learned HR. They'll get you where you need to go, but occasionally you might need to bring them up to speed on industry-specific nuances.

Best for: Growing cannabis companies that need a full HR suite along with payroll, particularly those transitioning from startup to more formal HR processes.

2 Budget-Friendly Cannabis Payroll Options

Kayapush: Dispensary-Focused Solution

Kayapush is the scrappy underdog that's laser-focused on making dispensary managers' lives easier. If you're running a retail shop and not dealing with grows or processing, these folks speak your language, and won't charge you for features you'll never use.

Their POS integration is where they really shine. The system pulls your sales data and automatically calculates those budtender commissions without you having to play accountant after a long day of customer service. No more Excel gymnastics or "did I pay that right?" moments.

The scheduling tool feels like it was designed by someone who's actually managed a dispensary floor. Create schedules, track time, and run payroll in one place, which is a lifesaver when you're juggling part-timers and coverage for those unexpectedly busy post-payday rushes.

At $35 per employee monthly, they're the budget pick on our list, and they'll have you up and running in about two weeks, perfect when you need to switch systems without disrupting your operation.

Just know what you're getting: they're retail specialists, not all-purpose players. If you start adding cultivation or processing to your business, you'll likely outgrow them. Their 280E handling covers the basics, but it's not their strongest suit. And while their support team knows cannabis retail inside-out, they're a smaller crew ,great when you get them, but sometimes you might wait a bit during busy periods.

Best for: Small dispensaries and cannabis retail operations that need cost-effective payroll with POS integration.

PayNW: Regional Cannabis Specialist

PayNW is the local hero for cannabis businesses in Washington, Oregon, and California. These folks aren't trying to be everywhere, they've doubled down on knowing every quirk and nuance of Pacific Northwest cannabis regulations like the back of their hand.

At $40 per employee monthly, they're reasonably priced, but what you're really paying for is having someone who answers the phone when you call and actually remembers your business. No robot menus or being bounced between departments, just straightforward support from people who know what you're dealing with in the PNW market.

Their 280E handling isn't fancy, but it gets the job done. They've got the essentials covered without overwhelming you with features you'll never touch. Implementation is quick and painless, usually wrapped up in 2-3 weeks, and their team can often tell you about compliance changes before they hit the news.

The catch? They're staying in their lane geographically. If your expansion plans include Colorado, Michigan, or the East Coast, you'll eventually need to shop for another solution. But if you're building your cannabis business in the Northwest, they're the neighbors who actually return your tools when they borrow them.

Best for: Cannabis businesses operating in the Pacific Northwest that value regional expertise and personalized service.

Key Features to Look for in Cannabis Payroll Software

When shopping for cannabis payroll software, don't compromise on these essentials, they're the difference between smooth sailing and sleepless nights.

First, get serious about 280E compliance. Your system should instantly know which expenses you can deduct and which ones the IRS will flag. It needs to talk to your accounting software and track COGS properly, because mistakes here aren't just annoying, they're expensive audits waiting to happen.

If you're in multiple states, you need software that keeps up with the regulatory patchwork without you babysitting it. Cannabis rules change constantly across states, and nobody has time to manually update payroll systems every time a legislature meets.

Banking integration is non-negotiable in this cash-heavy industry. Look for systems that work with cannabis-friendly banks, handle cash operations smoothly, and document everything meticulously, your banker will thank you.

Finally, demand reporting that's audit-ready from day one. When regulators knock (and they will), you need to pull detailed records in minutes, not days. Your system should make compliance documentation as easy as pressing a button.

Implementation Best Practices

Do a Compliance Check First

Before touching any new software, take a hard look at your current payroll setup. How are you handling those 280E expenses? Which banks are you working with? What state rules apply to you? Think of this as your "before" picture, it'll help spot potential train wrecks before they happen.

Plan Your Data Move Carefully

Your payroll history isn't just numbers, it's your compliance insurance policy. Work closely with your implementation team to make sure every dollar and deduction transfers correctly. Regulators don't accept "the data got lost during our software switch" as an excuse.

Train Your Team on the "Why," Not Just the "How"

Don't just show staff which buttons to click. Make sure they understand why cannabis payroll is different from regular payroll. Someone who gets the reasoning behind 280E categorization will make fewer mistakes than someone just following steps blindly.

Start Small, Then Expand

If you're running multiple locations, don't flip the switch everywhere at once. Pick one spot as your test case, work out the kinks, then roll out to others. You'll thank yourself when you're not troubleshooting problems across five dispensaries simultaneously.

Connect Your Software Ecosystem

The magic happens when your payroll talks to your POS, inventory, and accounting systems. Plan these connections carefully, they deliver the biggest value but can also cause the biggest headaches if rushed.

Be Realistic About Timing

Simple setups: 2-4 weeks

Complex multi-state operations: 6-8 weeks

More locations, more existing systems, and more historical data all add time. Don't schedule your implementation the week before 4/20 or tax deadlines.

Making Your Final Decision

Picking the right cannabis payroll system isn't just about finding software, it's about finding a partner who won't freak out when you mention terpenes or 280E. Don't pinch pennies here. The few extra bucks per employee for solid compliance features look like a bargain compared to what an audit might cost you. And trust us, in this industry, it's not if regulators come knocking, but when.

Look for a system that can grow with you and won't fall apart when you expand to another state or add cultivation to your retail operation. Just as important is finding support from people who actually understand cannabis, not just techs reading from a generic script who get confused when you mention METRC or plant-touching employees.

Based on our deep dive, Hybrid Payroll stands out from the pack for most cannabis businesses. They bring the right mix of industry-specific features, solid compliance tools, and support from people who speak your language. Most providers offer free demos, take them for a test drive with your actual data before committing. The hour you spend exploring options now could save you countless headaches and potentially expensive compliance issues down the road.

Frequently Asked Questions

How does 280E affect payroll software selection?

Not all payroll costs are treated equally under 280E. Cultivation labor might be deductible, but your admin staff's paychecks? Probably not. Regular payroll software doesn't know the difference, it's like bringing a knife to a gunfight. You need software that automatically sorts these expenses and talks to your accounting system, or you'll be manually fixing categorizations until your eyes bleed.

Can cannabis businesses use standard payroll software?

Sure, and you could also deliver weed on a unicycle, technically possible, but asking for trouble. Generic payroll systems don't handle 280E, cannabis-specific regulations, or banking restrictions. The money you save upfront will vanish the first time you face compliance issues or spend weekends manually fixing categorizations. Most businesses who try this route bail within a year.

What banking options work with cannabis payroll?

Banking in cannabis is still a mess, but it's getting better. Good cannabis payroll systems either partner with 420-friendly banks for ACH processing or have solid cash handling features built in. Don't waste time with providers who act shocked that you can't just set up direct deposit like any other business.

How much does cannabis payroll software cost?

Expect $35-65 per employee monthly. Yes, that's higher than regular payroll software, but one 280E audit will cost you more than years of software fees. Consider it compliance insurance with a side of convenience.

What compliance features are essential?

Don't compromise on automated 280E categorization, multi-state compliance, detailed audit trails, and cannabis-friendly banking options. These aren't luxury features, they're what keep you from becoming the IRS's next cautionary tale.

Comments