June 2024 – May 2025 Arizona Cannabis Market Report

- Cannabis Cactus

- Aug 14, 2025

- 3 min read

We’re diving into the market analytics for the state of Arizona to help both industry professionals and casual consumers understand how legalization continues to develop. These editorial insights, based on the latest BDSA Market Assessment, reveal a mature yet evolving cannabis landscape in Arizona.

AZ’s Cannabis Market by The Numbers

Flatline in Growth, Not in Opportunity

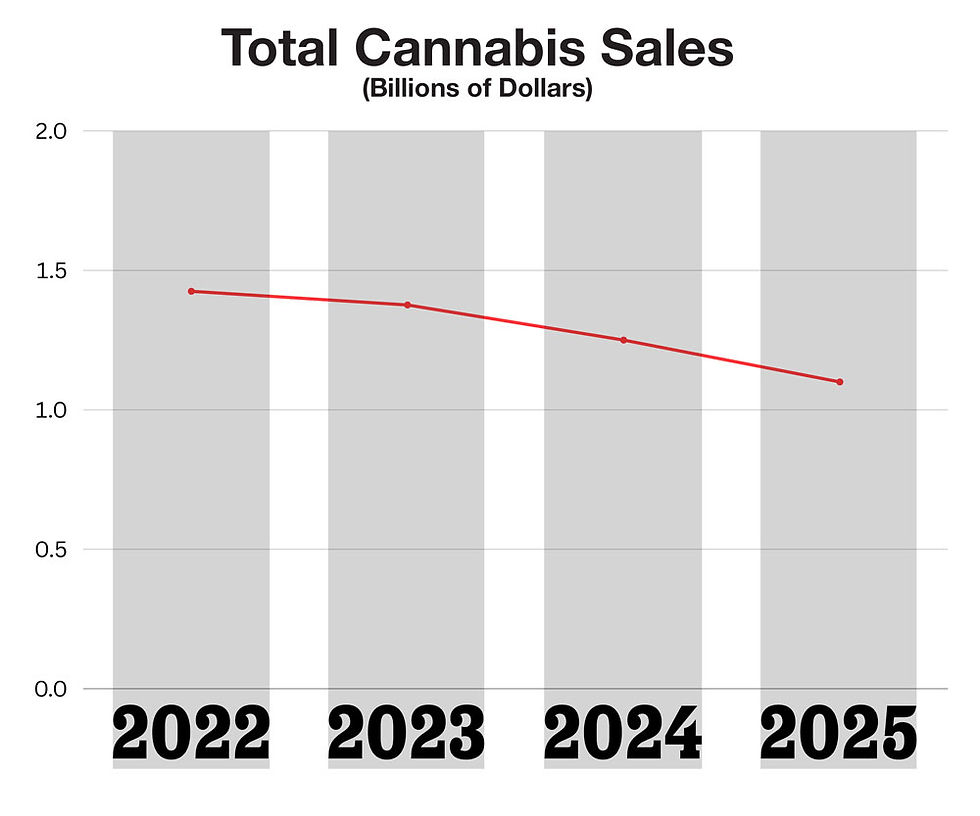

Retail cannabis sales in Arizona reached $1.2 billion over the past year. However, projections show a sluggish compound annual growth rate (CAGR) of just 0.2% through 2029. While this may seem like stagnation, it’s actually a signal of market maturity rather than saturation. There’s still significant opportunity in brand innovation, pricing strategies, and niche categories particularly sublinguals, infused beverages, and solventless extracts. Expect brands to churn and reposition as they compete for consumer loyalty and shelf space.

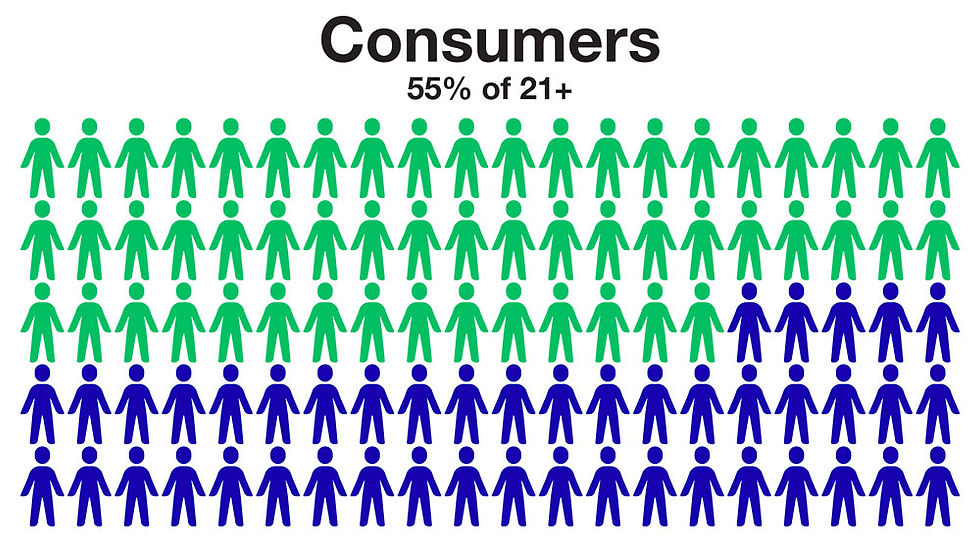

Half the Population Consumes

A staggering 55% of Arizona’s 21+ population reports cannabis use equating to roughly 3.2 million adults. Cannabis is no longer a fringe product. It’s mainstream, and that means marketing needs to reflect a wide range of lifestyles: from microdosing moms and yoga dads to blue-collar night-shift veterans and retirees. Cannabis culture is everyone’s culture now.

The Big Four

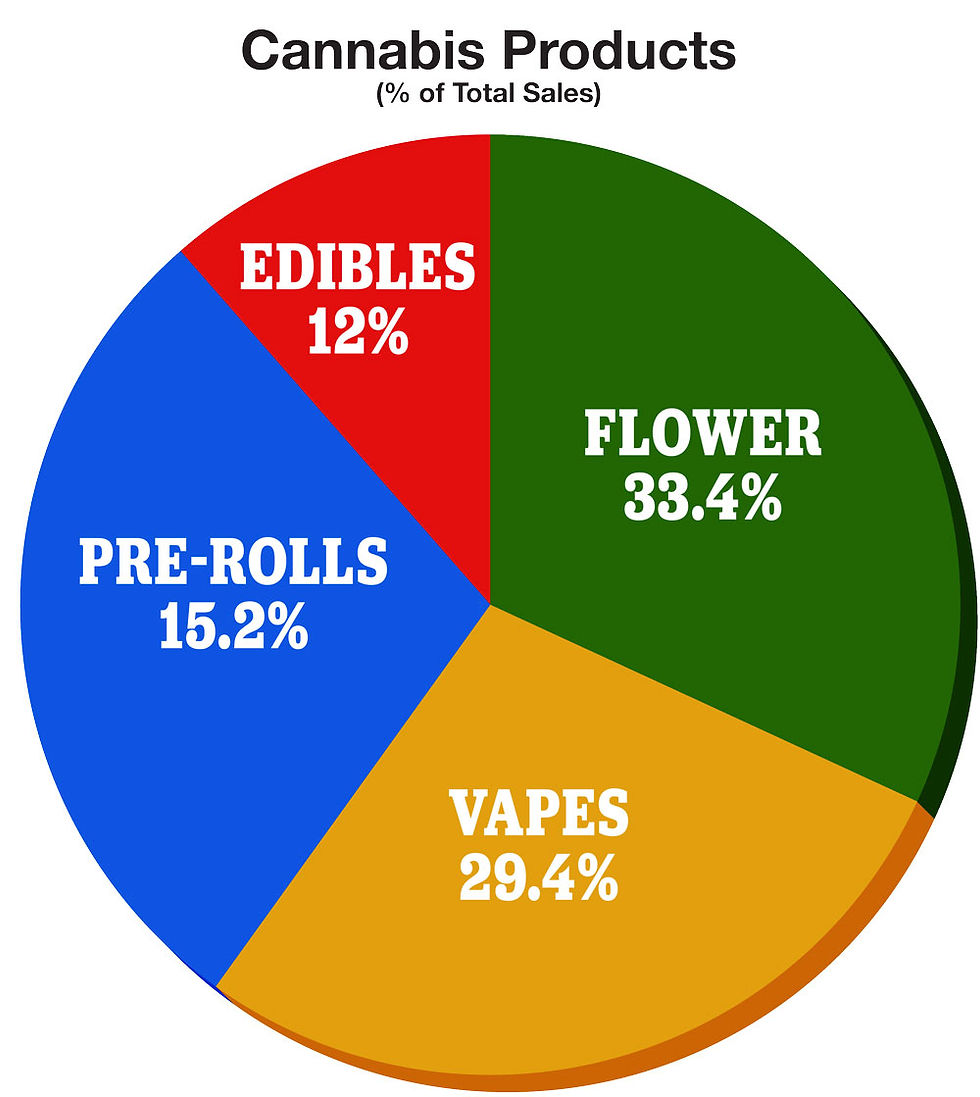

Arizona’s cannabis sales are concentrated in four main product categories:

Flower: 33.4% (still king, but slowly declining)

Vapes: 29.4% (stable, with strong MSO presence)

Pre-Rolls: 15.2% (rising, reflecting demand for convenience)

Edibles: 12.0% (seasonal and often value-driven)

Flower still holds the top spot, but its share is slipping slightly as consumers diversify. Pre-rolls are climbing in popularity, and edibles tend to spike in colder months. Editorially, this creates an opportunity to match product education with seasonal needs like highlighting terpenes for immunity, relaxation, or energy during specific times of year.

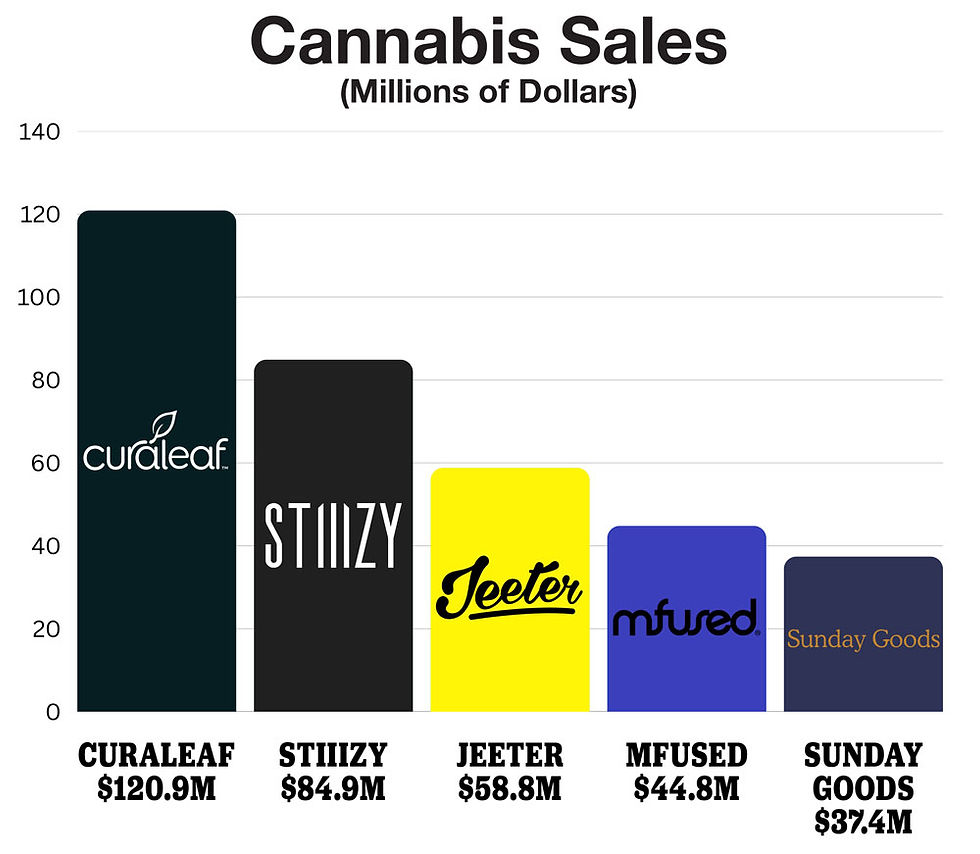

Winning the Retail Shelf

When it comes to total dollar sales, large multi-state operators (MSOs) dominate the leaderboard:

Curaleaf – $120.9M

Stiiizy – $84.9M

Jeeter – $58.8M

Mfused – $44.8M

Sunday Goods – $37.4M

Stiiizy and Jeeter are neck-and-neck in brand recognition, each claiming 5% market share. In the edibles category, Wyld continues to lead with $28 million in sales. Meanwhile, Grow Sciences carries the flag for premium, small-batch flower, staying true to its local craft roots.

The battle for shelf space reflects a split market: MSOs dominate volume, while craft brands command loyalty. Solventless products, rare strains, and functional edibles continue to be driven by connoisseurs and culture-first consumers.

Retail Pricing Pressures

Retail prices in Arizona are trending downward across the board. The average retail price (ARP) for cannabis products fell from $18.35 to $17.16 per package over just a few months. Flower, specifically, dropped from an average of $28.29 to $26.10 per eighth. Edibles are hovering around $10.55 per unit.

This pricing compression signals fierce competition and cost-conscious consumers. Brands hoping to survive this phase must differentiate through effects-based branding, consistent product experiences, and added value like terpene-forward multipacks or functional wellness blends.

Arizona’s Brand Landscape

There are currently 357 active cannabis brands in Arizona. Of these, 202 are multi-state operators, while 155 are Arizona-based single-state operators (SSOs). Consumers are nearly evenly divided and some prefer familiar national names, while others remain loyal to homegrown heroes.

At Cannabis Cactus Magazine, we love shining the light on the little guys doing it right. Brands like Elevate Cannabis, Mohave Cannabis, Abundant Organics, and Just Flower are examples of Arizona-based operators that bring integrity, flavor, and function to the forefront of the market. These brands are more than labels, they’re part of the state’s cannabis identity.

Comments